nebraska lottery tax calculator

Current Mega Millions Jackpot. You are able to use our nebraska state tax calculator to calculate your total tax costs in the tax year 202223.

Best Lottery Tax Calculator Mega Millions Powerball Lotto Tax

Nebraska lottery tax calculator.

. Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot. 25 State Tax. You may then be eligible for a refund or have to pay more tax when you file your returns depending on your total income.

The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Property Tax Credit Click here to learn more about this free subscription. Lucky for Life NE. 5 Nevada state tax on lottery winnings in the USA.

If you win the jackpot you will be subject to the top federal tax rate of 37 percent. This tool helps you calculate the exact amount. The calculator will display the taxes owed and the net jackpot what you take home after taxes.

Nebraskas state income tax system is similar to the federal system. Friday Sep 23 2022. Nebraska Salary Tax Calculator for the Tax Year 202223.

The lottery tax calculator helps you establish how much of the estimated jackpot amount will be taken by the state and federal tax rates. 69 Nebraska state tax on lottery winnings in the USA. You are able to use our Nebraska State Tax Calculator to calculate your total tax costs in the tax year 202223.

These lottery tools are here to help you make better decisions. There are four tax brackets in. You must report that money as income on your 2018 tax return.

Additional tax withheld dependent on the state. For postsecondary education private career schools nebraska college fund school closings state colleges university of nebraska. In other words it calculates how much cash is owed in.

This can range from 24 to 37 of your winnings. Calculate your lottery lump sum or annuity payout using. A federal tax of 24 percent will be taken from all prizes above 5000 including the jackpot before you receive your prize money.

This varies across states and can range from 0 to more than 8. Probably much less than you think. For one thing you can use our odds calculator to find the lotteries with the best chances of winning.

A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. Its a progressive system which means that taxpayers who earn more pay higher taxes.

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Best Lottery Tax Calculator Mega Millions Powerball Lotto Tax

Usa Lottery Tax Calculators Comparethelotto Com

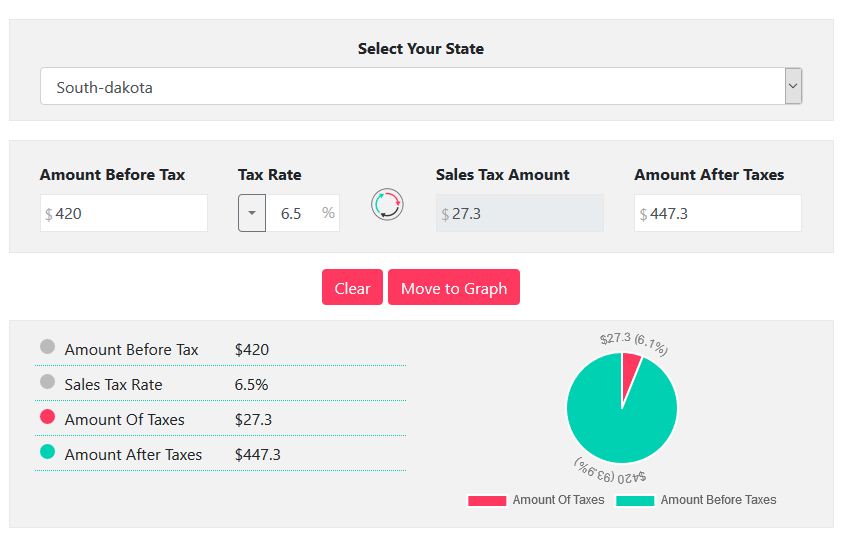

South Dakota Sales Tax Calculator Reverse Sales Dremployee

Buying Lottery Tickets Prize Swells To 1 1 Billion But Windfal Will Be Taxed Bloomberg

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

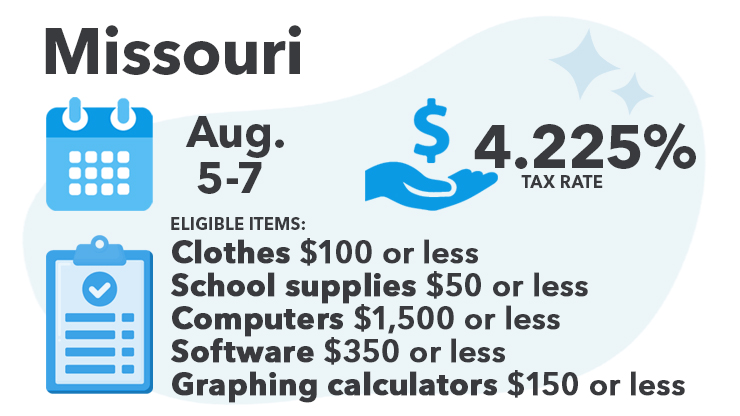

How To Boost Your Back To School Savings The Turbotax Blog

How To Boost Your Back To School Savings The Turbotax Blog

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator Updated 2022 Lottery N Go

Who Pays The Tax On A Special Needs Trust Legacy Design Strategies An Estate And Business Planning Law Firm

Sharp Ho El 330tb 8 Digit Solar And Battery Powered Lcd Calculator Pocket Calculators Calculator Desktop Calculator

Comparethelotto Usa Lottery Odds Calculators Results And More